Corporate Tax – The Truth That No One Is Talking About

When you hear about corporate tax rates, most people think of large corporations. The truth that no one is even mentioning is that corporate tax rates have a major impact on the potential success of small businesses.

I almost went bankrupt my first year of business because of corporate taxes.

Kate dillon

As an entrepreneur I wanted to discuss something that no one really talks about and it amazes me…Corporate Taxes. With my experience it really is amazing that I went from year one of my business to year two. When I started Crateinsider.com, I opened as a corporation. It’s the business structure that made the most sense at the time.

My intention was to be an S Corp, but I just didn’t know any better and my paperwork reflected that. I really wanted to share my experience of what my first year was like and how corporate taxes affect small business.

How taxes almost crushed my small business

I started building my website in January 2014, and launched it in April 2014. My first paycheck wasn’t possible until July. Instead, I lived on savings and credit cards. I held back on all spending and lived on ramen noodles and party pizzas.

At the end of 2014, I had paid myself $16,000 in gross wages. Yes, $16,000. That certainly isn’t a large amount.

For the sake of the business, I had scrimped, sacrificed, saved, and also put blood, sweat, and tears into the effort. What was it all for? At the end of the year, the profit equaled $5,798.29. I was thrilled. But, the excitement was short-lived.

At the end of year, I owed the state and federal governments $2225, AND another $2800 in payroll taxes for a grand total of $5079.28. Of the almost $6,000 profit the company made, only $3700 was not tied up in fixed assets, or inventory. So I now owe $5,079.28, and only have $3,700 in the bank.

GE Pays Zero in Corporate Taxes

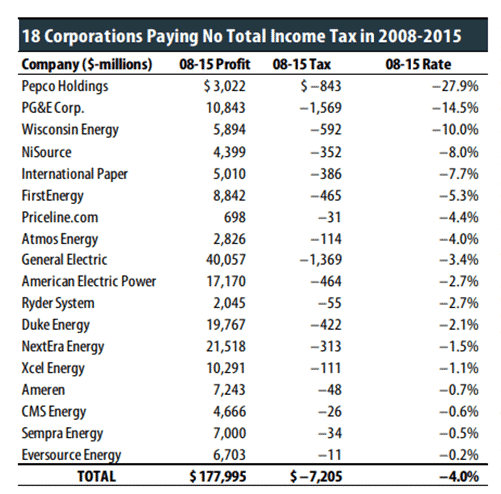

I was disgusted to see that the same year that I am basically under water, big corporations like GE were getting a tax refund.

titled “The 35 Percent Corporate Tax Myth – March 2017“

GENERAL ELECTRIC’S SPECIAL TAX LOOPHOLE LETS COMPANY DODGE BILLIONS IN TAXES

Corporate Taxes and Small Business

It makes a significant difference when you lower corporate tax rate. Next time you think about corporate taxes, consider the small and medium sized businesses. We small business owners don’t have money hidden in the Caiman Islands. We will bear the entire brunt of tax legislation.

Big businesses will always win and will have loopholes and workarounds. They have an army of lawyers and accountants. They also have the ability to move jobs and money overseas.

Raising corporate taxes hurts small businesses, families, and American employees. Small businesses are burdened, so they can’t hire more help. And workers for large corporations get laid off in favor of cheaper foreign labor.

Here’s the video. Feel free to share this video or post with your friends.

I’d love to invite you to join my email list. I send periodic updates on a variety of topics.